MINISTER of Finance and Planning Dr Peter Phillips says he will soon be meeting with International Monetary Fund (IMF) representatives to discuss the timelines for the next phase of negotiations.

"With respect to the negotiations with the IMF, I expect, in the next few weeks, to visit Washington to determine with the Fund the timelines for the next phase of our negotiations in the light of this (2012/13) Budget (including the revenue package) and the other outstanding issues," he said.

Closing the 2012/13 Budget Debate in the House of Representatives yesterday, the finance minister said every effort was being being made to conclude the negotiations post-haste.

"While one cannot predict with certainty the exact timing of the conclusion of the negotiations, I am working to bring them to a conclusion later this year," Dr Phillips said.

He noted that the IMF board met on May 30 to review Jamaica's 2011 Article IV consultation, which, among other things, provides an insight into the issues that will be of concern to the IMF's Board when it is asked to consider approving a successor programme to the aborted Stand-By Arrangement.

The minister pointed out that the report on the Article IV consultation will be published both by the Fund and the his ministry as soon as it is cleared for release.

"The draft report we have seen contains no surprises to anyone who followed my analysis of our current situation. The Board discussion and conclusions focused on some of the very areas which we have emphasised, that is, the need to: boost growth and competitiveness; and enhance fiscal sustainability," the minister said.

Dr Phillips said the IMF board broadly agreed with the assessment that a strong upfront fiscal adjustment is necessary to place the public debt on a clear downward path and to create buffers to protect against further negative shocks.

"In this regard, the IMF board stressed the importance of tax reform, containing public wages and employment, improving public financial management, and strengthening tax administration as necessary underpinnings of the fiscal consolidation efforts," he said.

In the meantime, he said the Government will be making "unprece-dented efforts to correct the slippages of the past year and is moving steadfastly to put in place a tax policy that aims at equity.

"We also intend to implement a system for parliamentary review that allows all of the people's representatives to participate to a greater degree in monitoring the programme. Hopefully, this will enhance and entrench the objectives of the fiscal responsibility framework. A broad range of issues and details are involved in coming to an agreement with the IMF," he said.

The finance minister said some of the areas of key importance are: wage restraint; pension reform; tax reform, including incentives and waivers reform and improvement in tax administration; and competitiveness reform, reducing impediments to doing business and reducing significantly the cost of energy.

FOREX-Dollar recovers on Bernanke, euro surrenders gains - Reuters

* Bernanke testimony offsets dollar weakness

* Surprise China rate cut boosts some riskier currencies

NEW YORK, June 7 (Reuters) - The euro surrendered all gains to traded little changed against the dollar o n Thursday after Federal Reserve Chairman Ben Bernanke said the U.S. central bank was ready to shield the economy but offered few hints that further monetary stimulus was imminent.

The news caused a sharp reversal in the euro, which earlier had traded to its highest since May after China's central bank cut benchmark rates to support growth in the world's second-largest economy.

The U.S. dollar had been hindered by expectations for more easing by the Federal Reserve, expectations that were countered by Bernanke's almost sanguine tone, which indicated the Fed was far from crisis mode..

"I don't think he is definitely saying that QE3 is on the way," said Fabian Eliasson, vice president of currency sales, Mizuho Corporate Bank in New York. "He's saying what he has said before, reassuring people that they will act if things deteriorate further. In other words, they are there if needed, but they don't feel they are needed yet."

The euro was last at $1.2568, little changed from the prior close.

"Despite economic difficulties in Europe, the demand for U.S. exports has held up well," Bernanke told Congress.

Earlier the euro had climbed to a session high of $1.2625, using Reuters data, its highest level since May 23, before surrendering gains. Traders had earlier cited resistance around $1.2625.

The euro also climbed to its highest since May 23 against the yen at 100.61 yen before surrendering some gains to trade at 99.93 yen, up 0.4 percent.

Until Bernanke, trading had been influenced by China's delivery of twin surprises on interest rates, cutting borrowing costs to combat faltering growth while giving banks additional flexibility to set deposit rates. [ID:nL3E8H76KL}.

"Rate cuts in China serve to reduce China's exposure to global weakness," said Douglas Borthwick, managing director of Faros Trading in Stamford, Connecticut. "Rate cuts in combination with a stimulus program - still to be announced, should shelter Asia somewhat from global weakness, and should help keep a bid to Asian growth and currencies."

Decent demand at a Spanish bond auction and expectations that European policymakers may take further steps to support the global economy also led to demand for perceived riskier currencies such as the Australian dollar, which rose to a three-week high.

The global economy has floundered in recent weeks, and risks to growth have mounted on concerns about a possible Greek exit from the euro zone and the fragility of the Spanish banking system, putting pressure on euro zone politicians and global central banks to come up with a credible policy response.

Speculation that Spain could become the fourth euro zone country to need an international bailout prompted investors to sell the euro heavily last week, although European sources have said Germany and European Union officials are urgently exploring ways to support the country's stricken banks.

Many market players were already expecting euro gains to be limited. A Reuters poll suggested the euro was unlikely to recoup recent steep losses against the dollar in the next 12 months.

"The euro can bounce up to $1.2630 but then it will be a sell on rallies as Europe's problems are ... considerable," said Stuart Frost, head of Absolute Returns and Currency at fund manager RWC Partners in London.

The dollar managed to outperform the yen which was hit broadly as risk appetite improved and also dampened by recent threats from Japanese authorities to curb its strength.

The dollar was 0.5 percent higher at 79.61 yen after posting a session peak of 79.78, also the highest since May 23 using Reuters data, well off a 3-1/2 month trough set on June 1.

The dollar was also bolstered against the yen by a report showing the number of Americans lining up for new jobless benefits fell last week for the first time since April, a reminder that the wounded labor market is still slowly healing.

"The number was very close to expectations," said Vassili Serebriakov, senior currency strategist at Wells Fargo in New York. "We've had a deterioration in the last few months and now it looks like claims are plateauing."

Does Floyd Mayweather fight just for money? - BoxingNews24.com

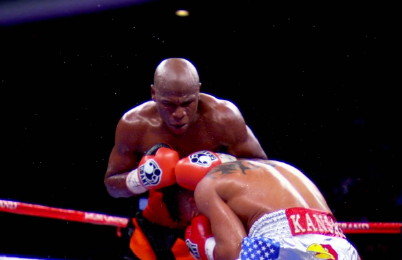

By Dominic Sauboorah: It is without question that Floyd “Money” Mayweather is one of the greatest boxers to have ever graced the sport. His defensive style is considered to be the greatest of all time which many would find hard to disagree with, considering the fact that he’s still undefeated after 43 fights and has never been knocked down in his career.

By Dominic Sauboorah: It is without question that Floyd “Money” Mayweather is one of the greatest boxers to have ever graced the sport. His defensive style is considered to be the greatest of all time which many would find hard to disagree with, considering the fact that he’s still undefeated after 43 fights and has never been knocked down in his career.

Obviously boxers want to make a lot of money in the sport; however Mayweather seems to make it his priority. A perfect example that backs this up could be his inability to make a financial agreement with pound for pound champion Manny Pacquiao, who was willing to do a 50/50 split with Mayweather. Sounds fair considering that to the majority of the public it’s considered a pick ‘em fight. The money man however wants to do a 60/40 split with Pacquiao, thereby giving him more of the revenue from the fight. Floyd has blamed Bob Arum many times about this fight not taking place but with all due respect if he really wanted the fight to happen then money shouldn’t the big issue involved. Obviously he wants to earn a fair amount of money from the fight but it shouldn’t determine if the fight takes place or not. Floyd Mayweather was even ironically quoted as saying “lets give the fans what they want which is Mayeather Pacquiao.” Well if Pacquiao is agreeing to the blood testing and the fight still isn’t taking place then clearly Mayweather’s only concern is money, which of course is a necessary aspect but isn’t a majorly important one. Also Larry Merchant asked Mayweather after his victory over Miguel Cotto whether or not his financial predicament with Manny Pacquiao was the reason for the fight not happening and instead of answering the question he replied by mentioning the blood and urine test situation which, like I said before, has apparently already been resolved. This then suggests that Mayweather dodged Larry Merchant’s question to do with money, due to the fact that he doesn’t want the public to see him as the reason for the fight not taking place.

I have a lot of respect for Floyd Mayweather, as a fighter and as a person, but at the end of the day it seems as if money is the only thing stopping this fight from happening. To say that Mayweather is being selfish is an understatement in my view. He said he wants to give the fans what they want. Well, it seems like he doesn’t. One of the greatest boxers of our era and of all time may be recognized to many in the future as a fraud if this proposed fight with Manny Pacquiao doesn’t take place due to his obsession over money.

Money looming even larger over Nov. election - CBS News

(CBS News) WASHINGTON -- President Obama is halfway through a two-day fundraising swing through California.

His trip underlines the importance of money in the 2012 campaign.

It's also being criticized by Republicans who say the president is spending too much time with celebrity Democrats.

The money-raising trip took him to San Francisco and Los Angeles, two towns where he hasn't been a stranger in recent weeks and months, spending plenty of time with the wealthy and famous in the entertainment and tech communities.

But his campaign tweeted Thursday that 98 percent of its donations in May were less than $250.

Either way, it's all about the money.

Mr. Obama got a warm welcome from campaign donors in the Los Angeles gay community Wednesday night, a group he considers crucial to his re-election prospects.

"I could not be prouder of the work we've done on behalf of the LGBT community," Mr. Obama said.

During his speech, he ticked off accomplishments under his watch, such as ending the war in Iraq.

But he also warned the audience about what's ahead during the campaign, and why their donations matter, saying, "You're going to see hundreds of millions of dollars in negative ads, because the other side's not offering anything new."

To build a war chest that would enable him to counter those ads and run his campaign, Mr. Obama is spending two days on the West Coast to raise an expected $5 million.

He will have done 153 fundraisers since formally declaring his candidacy for re-election a little over a year ago - nearly double the number President Bush had done at the same point in 2004.

With the majority of outside super PAC dollars going to Republicans, raising money will be crucially important for Democrats in this election cycle.

In the Wisconsin recall election, unions spearheaded the effort to unseat Gov. Scott Walker after he successfully limited their power. But the union effort to get out the vote was overcome by the GOP advantage in money and TV advertising. Walker raised $30 million. His challenger, Milwaukee Mayor Tom Barrett, raised only $4 million.

Rep. Steve Israel, D-N.Y., chair of the Democrats' campaign committee, warned that the Wisconsin results should be "a wake-up call" that the party needs money for TV ads to compete with the super PACs.

A California political power broker once put it this way: "Money is the mothers' milk of politics."

Four years ago, candidate Obama outspent his Republican opponent, Sen. John McCain by more than two-to-one - $730 million to $333 million.

To see Bill Plante's report, click on the video in the player above.

Finance Minister Biti a 'punch bag', says prominent labour consultant - The Zimbabwean

"Our Minister of Finance, Tendai Biti, is a punch bag," Makings said in Harare addressing business people gathered for the monthly Express Management meeting.

This meeting is sponsored by the British Council and is attended by prominent business people especially those that were trained in the United Kingdom (UK).

"He cannot do anything right now because his hands are tied.

"What he says and does is all controlled by the government which as you know is broke and so there is really nothing that he can do to solve the economic crisis.

"We really cannot blame Tendai Biti because he is just a punch bag in the government."

The statement comes at a time when Zimbabwe is expecting a high level delegation from the Washington-based International Monetary Fund (IMF) in the country.

The delegation is coming to Zimbabwe to investigate and try to find out the nation's economic recovery progress.

"The IMF are coming next month (June) to see how we are faring," Anthony Hawkins Head of the University of Zimbabwe's Business School, said in an exclusive interview last month.

He said:"There is nothing really new about this but I think this time around they will ask where our diamond cash is going to and how it is being used.

"As you probably know the Minister of Finance, Tendai Biti, has said we could earn about $600 million from diamonds but the Minister of Mines and Mining Development, Obert Mpofu, on the other hand, says this might not be the case and so this will have to be clarified to the delegation."

Hawkins said he did not know whether Zimbabwe has paid anything yet to the IMF.

"I cannot comment on our repayment schedule because I have not heard about any repayments yet," he said.

"However, they will be worried about our diamond cash just like they were worried about the oil cash in Angola and how that was used before they could come in and help that country."

Hawkins said as long as the country did not repay its outstanding debts, the IMF would not "budge a finger" to help the economic recovery programme.

Zimbabwe's outstanding arrears to the IMF have now reached $140 million at a time when the country owes the Washington-based group $550 million, Biti, the Minister of Finance, has already confirmed.

He said Zimbabwe's outstanding arrears under the Fund's Extended Credit Facility (ECF) now amount to $140 million.

The ECF replaced the Fund's Poverty Reduction and Growth Facility.

"Zimbabwe does not have the capacity to pay off the IMF's arrears from its own resources," Biti said in Harare.

"In this regard, the country will need to request cooperating partners for a concessional bridging loan or grant to settle arrears to the IMF."

He said clearance pf ECF arrears would unlock new financing arrangements from the IMF, within the context of a Fund supported financial arrangement, which would then be used to repay the bridging loan obtained from the cooperating partners.

"Zimbabwe will, however, need a track record of implementing sound macro-economic policies and assurances that arrears to other official creditors are programmed to be cleared," Biti said.

Biti has already confirmed that Zimbabwe owes multilateral institutions a grand total of $2,504 billion, of which the World Bank is owed $1,126 billion, the IMF, $550 million, the African Development Bank (AfDB) $529 million, and the European Investment Bank (EIB), $221 million.

President Robert Mugabe has said there is an urgent need for Zimbabwe to achieve external debt sustainability through a comprehensive debt relief and arrears clearance programme.

"This must be strongly supported by my government and all the development partners and creditors," President Mugabe said.

Prime Minister, Morgan Tsvangirai, has also said it is "clear that Zimbabwe cannot rehabilitate its infrastructure and move forward with its socio-economic transformation reforms if the debt overhang challenge is not urgently resolved".

Forex: AUD/USD firm above 0.9900 - NASDAQ

FXstreet.com (Barcelona) - Fourth consecutive daily advance for the AUD so far, bolstered by increasing risk appetite in the global markets.

After a dreadful May, the Aussie dollar is finding some relief at the beginning of June: the RBA cut the overnight rate 'only' 25 bps on Tuesday, against a widely expected 50 bps; GDP figures for the first quarter have surprised growing 4.3% YoY and the unemployment rate has come in at 5.1% early in the Asian session, in line with expectations.

J.Kruger, Technical Strategist at DailyFX, affirms that the bearish outlook on the cross remains unchanged, although he assesses the likeliness of a rebound due to technical studies showing 'oversold' conditions, "…and we see shorter-term risks for more of a bounce towards 1.0000-1.0200 area where the next major lower top is sought out ahead of underlying bear trend resumption…".

AUD/USD is now advancing 0.32% at 0.9946, with the next hurdle at 1.0016 (high May 15) ahead of 1.0028 (50% of 1.0475-0.9581) and 1.0070 (high May 14).

On the flip side, a violation of 0.9875 (hourly sup Jun.6) would bring 0.9767 (MA10d) and 0.9738 (hourly low Jun.6).

No comments:

Post a Comment