INLSA

Minister of Higher Education Blade Nzimande

Minister of Higher Education and Training Blade Nzimande has lashed out at FET students who had turned state financial aid meant to help the needy into a “cash cow”.

This year, R1.7 billion has been allocated in bursaries for students at Further Education and Training (FET) colleges.

In addition to having their fees paid, students can claim up to R6 000 a year for transport. They can also claim for accommodation.

However, Nzimande, who was speaking at a media briefing in Durban on Monday, stressed that the department would only meet genuine transport and accommodation bills. And students whose transport bills came to less than R6 000 could not claim the balance, or “change”, he said.

“We cannot allow money meant to assist students with their studies and transport to be used as a cash cow. Any unused funds will be allocated in the following year... It cannot be abused. FETs are not social welfares and we do not give money for (cellphone) airtime. Those who ask for change must know, there is no change,” Nzimande said.

He called on student organisations, parents and communities to ensure that government money was not abused.

Nzimande said that the appointment of chief financial officers at KwaZulu-Natal’s nine public FET colleges would help them to better manage bursary funds.

Touching on the issue of the more than 70 FET students who were last month kicked out of a South Coast college’s dormitories after a row over the observance of Islamic customs and rules, Nzimande said the department was investigating.

The Coastal KZN As-Salaam campus in Braemar, near Umzinto, suspended lessons three weeks ago after students protested that those staying in the dormitories were being forced to follow Islam.

Thembisa Futshane, the department’s acting chief dir-ector of planning and institutional support, said the bursary was a grant which students were not required to repay, but they were required to provide proof they had paid for transport and accommodation.

SA Students’ Congress KZN secretary Phinda Mafokeng said many students came from poor backgrounds and some were using the money to support their families.

Money market report for week ended June 1 - Times of Malta

On Monday, May 28, the ECB announced its weekly Main Refinancing Operation (MRO). The auction was conducted on Tuesday, May 29, and attracted bids from euro area eligible counterparties of €51.18 billion, €13.32 billion higher than the bid amount in the previous week. The amount was allotted in full at a fixed rate equivalent to the prevailing main refinancing rate of one per cent, in accordance with current ECB policy.

Also on Tuesday, May 29, the ECB conducted an auction for a seven-day fixed-term deposit intended to absorb €212 billion. This operation was designed to sterilise the effect of purchases made under the Securities Markets Programme that were settled but had not yet matured by the previous Friday, May 25. The auction was carried out at a variable rate, with euro area eligible counterparties allowed to place up to four bids at a maximum rate of one per cent. It attracted bids amounting to €420 billion, with the ECB allotting €212 billion, or 50.48 per cent of the total bid amount. The marginal rate on the auction was set at 0.26 per cent, with the weighted average rate at 0.26 per cent.

On Wednesday, May 30, the ECB conducted a three-month Longer-Term Refinancing Operation to be settled as a fixed rate tender procedure with full allotment, with the rate fixed at the average rate of the MROs over the life of the operation. The auction attracted bids of €8.31 billion from euro area eligible counterparties, which amount was allotted in full, in accordance with current ECB policy.

Furthermore, on Wednesday, May 30, the ECB conducted a seven-day US dollar funding operation through collateralised lending in conjunction with the US Federal Reserve. This operation attracted bids of $0.50 billion, which was allotted in full at a fixed rate of 0.66 per cent.

Domestic Treasury bill market

In the domestic primary market for Treasury bills, the Treasury invited tenders for 91-day bills maturing on August 31. Bids of €13 million were submitted, with the Treasury accepting €8 million. Since €2 million worth of bills matured during the week, the outstanding balance of Treasury bills increased by €6 million, to stand at €267.45 million.

The yield from the 91-day bill auction was 1.039 per cent, i.e. 1.2 basis points higher than that on bills with a similar tenor issued on May 25, representing a bid price of 99.7381 per 100 nominal.

During the week under review, there was no trading on the Malta Stock Exchange.

Today, the Treasury will invite tenders for 91-day bills and 182-day bills maturing on September 7, and December 7, respectively.

Eurozone crisis live: G7 finance ministers to hold emergency talks - The Guardian

Reuters is reporting that G7 finance minister will hold their conference call to discuss the eurozone crisis at 11am GMT, so in an hour and half's time.

More euro economic gloom -- retail sales across the single currency region fell by 1.0% in April, compared with March. That's the biggest monthly fall since last December.

On a year-on-year basis, retail sales were 2.5% lower than a year ago.

Howard Archer of IHS Global Insight said it was "a dismal day for the Eurozone on the economic front" (with the service sector shrinking at its fastest rate in almost three years).

After an early rally, European stock markets have dropped back, with Germany's DAX in the red again:

DAX: down 54 points at 5923, - 0.9%

CAC: up 7 points at 2962, + 0.26%

IBEX: up 20 points at 6260, + 0.29%

Europe's service sector has suffered its worst monthly decline in almost three years, in the latest evidence that the region's economy is shrinking.

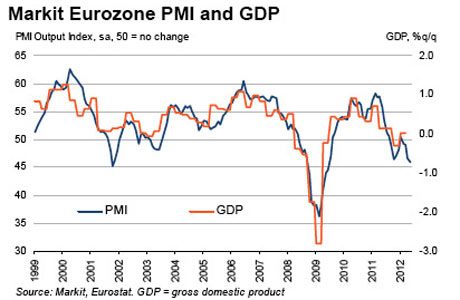

Markit reported its latest PMI data this morning, and the picture across Europe was pretty bleak. Germany's service sector grew at its weakest amount for six months in May, while most other countries' sectors shrank:

Germany: 51.8 (where >50= growth, and <50=contraction)

Spain: 41.8

Italian: 42.8

France: 45.1

When combined with last Friday's manufacturing data (which was also grim), the data shows that the Eurozone's private sector shrank at its fastest pace since June 2009. At 46.0, May's 'composite PMI' was the fourth month in a row to show a contraction. Even Germany's output fell, although at a slower rate than the rest of the eurozone.

Latest economic data shows Europe's economy is shrinking.

Latest economic data shows Europe's economy is shrinking. Chris Williamson, Markit's chief economist, said the data suggests eurozone GDP will fall by as much as 0.5% this quarter (having stagnated in Q1).

There is some convergence among member countries, but unfortunately only in the sense that all of the largest are now experiencing downturns. While Germany is contracting only marginally, alarmingly steep downturns are evident in Spain, Italy and now also France.

Italy seems to be faring the worst, with its PMI consistent with GDP falling by more than 1% in the second quarter.

Spain's Treasury minister has caused some disquiet this morning by stating that the country is effectively shut out of the bond markets -- just two day before it holds a debt sale.

Cristobal Montoro also appeared to signal that Spain needs international help, but not a full bailout, in an interview with Spanish broadcaster Onda Cero.

Montoro told the radio station that:

The risk premium says Spain doesn't have the market door open...The risk premium says that as a state we have a problem in accessing markets, when we need to refinance our debt.

Spain's 'risk premium', measured by the difference between the yield on its 10-year bonds and the German equivalent hit record levels last week. As I type, the spread between the two bond yields is 515 basis points - a massive difference in borrowing costs.

Spain is due to auction €2bn of medium-term debt on Thursday.

Montoro expressed strong support for Europe to create a closer "banking union", saying a decision should be taken at the next EU summit at the end of June. He also argued that "European institutions" should provide funding to help recapitalise its banks, saying Spain needs to show how it will strengthen its banking sector.

That's why it's so important that the European institutions open up and help us achieve, help facilitate, that figure because we're not talking about astronomical figures.

Bloomberg reckons this is the first time a Spanish minister has called for outside funds. Prime minister Mariano Rajoy has long argued that the European Stability Mechanism should be able to recapitalise European banks directly (rather than via the state), without going as far as to state that Spain needs their help.

Montoro also said it was 'technically impossible' to bailout Spain itself – an acknowledgement that Europe's firewall isn't strong enough.

Britain saw its credit rating cut by one notch last night, by ratings agency Egan Jones.

Egan Jones slashed the UK's rating by one notch to AA-minus, from AA, and left a negative outlook on the rating. It warned that Britain may fail to trim its deficit as quickly has planned, saying in a statement that:

The over-riding concern is whether the country will be able to continue to cut its deficit in the face of weaker economic conditions and a possible deterioration in the country's financial sector

Not a very nice way to mark the Queen's Diamond Jubilee...

Egan Jones isn't one of the Big Three rating agencies, and at present it rates many countries as more of a credit risk than Moody's, S&P or Fitch.

Our Europe editor, Ian Traynor, argues in today's Guardian that a "United States of Europe" may be the only way to save the eurozone. Here's a flavour:

The USE – United States of Europe – is back. For the eurozone, at least. Such "political union", surrendering fundamental powers to Brussels, Luxembourg and Strasbourg, has always been several steps too far for the French to consider.

But Berlin is signalling that if it is to carry the can for what it sees as the failures of others there will need to be incremental but major integrationist moves towards a banking, fiscal, and ultimately political union in the eurozone.

It is a divisive and contested notion which Merkel did not always favour. In the heat of the crisis, however, she now appears to see no alternative.

The next three weeks will bring frantic activity to this end as a quartet of senior EU fixers race from capital to capital sounding out the scope of the possible.

As Rainman2 points out in the reader comments, three of Portugal's banks are being recapitalised to the tune of €6.6bn.

The move will mean Banco Commercial Portugues, Banco BPI and Caixa Geral de Depósitos can all hit Europe's tougher capital reserve requirements. The money is coming from Portugal's €78bn bailout (agreed last year, which included €12bn for its financial sector).

Crucially, Portugal is still meeting the terms of its rescue package, despite fears that a second bailout might be needed. Its Troika of lenders announced last night that the Portuguese financial reform programme "remains on track amidst continued challenges." That decision means Lisbon will receive its next tranches of aid, totalling €4.1bn.

The financial markets, though, are still pricing Portugal as a serious risk. It's 10-year bonds are trading at a yield of around 11.5% today, deep into the 'danger zone'.

Canada's finance minister Jim Flaherty. Photograph: Chris Wattie/Reuters

Canada's finance minister Jim Flaherty. Photograph: Chris Wattie/Reuters The news that G7 finance chiefs are to hold a teleconference call today is a clear signal from the world's largest economies that the Eurozone must take rapid steps to stem the crisis.

The call was first revealed by Canadian finance minister Jim Flaherty last night. He told reporters that ministers and central bankers from Canada, the US, Britain, Japan, Germany, France and Italy would hold a special conference call to discuss the eurozone crisis, explaining that:

The real concern right now is Europe of course – the weakness in some of the banks in Europe, the fact they're undercapitalised, the fact the other European countries in the eurozone have not taken sufficient action yet to address those issues of undercapitalisation of banks and building an adequate firewall.

This mesage was reiterated by the US government, with White House press secretary Jay Carney warning that "more steps need to be taken" to address the crisis and reassure the financial markets.

And overnight, Japan's finance minister, Jun Azumi, also confirmed that concerns over the eurozone crisis are now dangerously high, warning:

We have reached a point where we need to have a common understanding about the problems we are facing.

G7 conference calls are usually confidential, so Flaherty's decision to go public may indicate that world leaders are keen to apply the maximum pressure to the eurozone. We don't yet know when the call is taking place.....

Here's a quick agenda of some of the main events and economic data coming up:

• G7 finance ministers hold conference call: timing currently unknown

• Eurozone purchasing manager index on services for May: 9am BST

• Eurozone retail sales for April: 10am BST / 11am CEST

• German factory orders for April: 11am BST/ noon CEST

• Bank of Canada's interest rate decision: 2pm BST/ 9am EDT

Good morning, and welcome back to our rolling coverage of the eurozone financial crisis.

After a day off yesterday to toast her Majesty and put up more bunting, we're back to track the latest action across Europe. The key development this morning is that G7 finance ministers are due to hold emergency talks on the euro zone debt crisis later today. More on this shortly.

Across Europe, pressure is growing on Germany to accept a 'banking union' across Europe. As my colleagues Ian Traynor and Giles Tremlett report:

Europe's leaders appear to be edging towards an ambitious and controversial new blueprint for a federalised eurozone after Paris and Brussels threw their weight behind Spain's pleas for an EU rescue of its beleaguered banks.

At the start of three weeks likely to be crucial to the survival of the euro, the new French government and the European commission voiced strong backing for a new eurozone "banking union" to save the single currency.

The plan could see vast national debt and banking liabilities pooled – and then backed by the financial strength of Germany – in return for eurozone governments surrendering sovereignty over their budgets and fiscal policies to a central eurozone authority.

A "gang of four" – the European council president, the commission chief, the president of the European Central Bank and the head of the eurogroup of 17 finance ministers – has been charged with drafting the proposals for a deeper eurozone fiscal union, to be presented to an EU summit at the end of the month.

Things may be quieter than normal, with the UK enjoying another bank holiday today. But other European markets will be trading as usual, after a mixed day yesterday, so there should be plenty to report. There's also some interesting economic data due, covering the world's service sectors, eurozone retail sale, and German factory orders.

Duke, GE Tempt Savers With Higher Yield Than Money Funds - Bloomberg

Duke Energy Corp. (DUK), Ford Motor Co. (F) and General Electric Co. (GE) are enticing a growing number of individuals to buy their debt through investments pitched as higher-yield alternatives to checking accounts and money funds.

These and other companies that sell the debt, called floating-rate demand notes, are exploiting frustration with money-market funds paying an average 0.03 percent as of May 29 and bank savings accounts at 0.13 percent. The notes, which usually require a minimum deposit such as $500 or $1,000 and offer checks to access the money, are paying 1 percent to 1.6 percent.

The notes help companies diversify their funding, which is skewed to securities such as commercial paper and bonds bought mainly by institutions. For retail investors, they provide less protection than an insured bank account or a money fund that holds debt from many issuers. The notes aren’t secured.

“It looks like these programs are a much better deal for the company than they are for the individual investor,” said David Sekera, corporate bond strategist at Chicago-based research firm Morningstar Inc. (MORN) “These programs don’t appear to pay enough extra spread over money-market funds to compensate the investors for the credit risk and lack of diversification.”

Issuers generally can change payout rates weekly. Duke Energy, a Charlotte, North Carolina-based utility, and Ford Credit, the company’s finance unit, promise to pay at least 0.25 percent more than the average money fund rate. Fairfield, Connecticut-based GE doesn’t guarantee a minimum.

Checkbook Bond

“I like to call them a bond with a checkbook,” said John Heffernan, director of the PremierNotes program at Duke Energy. “The unique thing about this is we’re selling them directly to the investors.”

Duke Energy started offering floating-rate notes to individuals about a year ago, marketing them first to employees and through billing inserts to customers before advertising in newspapers, Heffernan said in an interview. The amount of debt outstanding through the program increased 59 percent to $126 million as of March 31.

The finance arm of Peoria, Illinois-based Caterpillar Inc. (CAT), the world’s largest construction-equipment maker, had about $550 million outstanding in the floating-rate demand notes as of December. Detroit-based Ally Financial Inc. (ALLY), the auto-finance company, had issued about $3 billion outstanding in a similar product as of March 31.

Caterpillar’s notes are available to the general public. Ally’s generally are offered to its employees, retirees and immediate family members, as well as those at General Motors Co. (GM) and the Chrysler group of companies, said spokeswoman Gina Proia.

GE Capital

“Looking for CD or Money Market Rates? You can do better,” according to the marketing on GE’s Interest Plus website. The notes are issued by GE Capital, the finance unit of the industrial and financial-services company. GE has been offering the notes to individuals since 1992. It had $8.7 billion outstanding as of March 31, compared with $5.6 billion at the end of 2008.

“The real benefit of this product is flexibility,” Russell Wilkerson, a spokesman for GE Capital, said in an interview. “It allows customers to come in without a sales fee and exit at any time without a penalty. That supreme flexibility and an attractive yield is the strength of the offering.”

If a corporation selling these notes defaulted, investors’ money would probably be tied up in bankruptcy court and they may lose a significant portion of their investment, Sekera said.

While the investments let investors write checks against them and access the money daily, they aren’t insured by the Federal Deposit Insurance Corp. against losses and there are restrictions. Duke Energy requires that checks written or online transfers total at least $250.

No Trading

The notes, unlike traditional bonds, don’t have stated maturity dates and aren’t tradable in a secondary market. Buyers must rely on the company issuing them to get their money back.

People “tend to use it like a savings account or a money- market account,” Brad Reynolds, chief investment officer for LJPR LLC, said of Ford Credit’s Interest Advantage notes. Investors who are also employees of the companies may be inadequately diversified if there are credit problems with the issuers, said Troy, Michigan-based Reynolds, who works with clients who invest in the notes.

Money-market funds by comparison pool assets from a variety of sources.

“A money market fund is a diversified, professionally managed, highly transparent portfolio consisting of high- quality, liquid assets and governed by all the investor protections of a mutual fund,” Rachel McTague, a spokeswoman for the Washington-based Investment Company Institute, a lobbying group for mutual-fund companies, said in an e-mailed statement.

Money Funds

The staff of the Securities and Exchange Commission has been drafting two proposals aimed at reducing the risk money- market funds may pose to financial stability. The first would strip funds of their traditional fixed $1 share price, substituting a floating value. The second would impose capital requirements and restrict redemptions.

Duke Energy and GE Capital both said they are transparent about how the products work and that it’s the responsibility of individuals to determine what investments are right for them depending on their risk tolerance.

Ford Credit, a unit of the Dearborn, Michigan-based automaker, prominently discloses how its notes differ from bank accounts or other guaranteed products, said spokeswoman Margaret Mellott. The company had about $4.7 billion outstanding in its demand notes at the end of 2011.

Some of the companies issuing the notes generally can’t sell commercial paper to money-market funds because their short- term debt isn’t top-rated, said Peter Crane, president of Crane Data, which tracks money markets.

Credit Ratings

Moody’s Investors Service on May 22 raised the unsecured credit ratings of Ford and its finance unit to investment grade from junk status. Money-market funds generally can’t hold the company’s short-term debt, which was raised to P-3, the lowest level of investment grade, from Not Prime by Moody’s. GE’s short-term debt is rated first tier by Moody’s and S&P, while Duke Energy’s is rated P-2 by Moody’s and A-2 by S&P.

Investors should look up the ratings for the different companies offering these programs and check both the short-term and long-term ratings, said Morningstar’s Sekera. While the probability of a large corporation going bankrupt is low, the failure of companies such as Enron Corp. and Lehman Brothers Holdings Inc. are evidence that it’s possible, he said.

Setting Rates

Duke Energy and GE Capital have internal committees that can reset the rates paid on the accounts weekly. Ford Credit updates the rates weekly to reflect money-market rates plus 25 basis points and may pay greater than that “at its sole discretion,” according to the notes’ prospectus. Mellott, the spokeswoman, declined to comment beyond the prospectus on how the company sets its rates.

Duke Energy currently pays investors 1.2 percent for accounts less than $10,000 and as much as 1.6 percent for those with more than $50,000. GE Capital and Ford Credit paid a rate of 1 percent for investments of less than $15,000 and as much as 1.1 percent on amounts greater than $50,000 as of June 4.

Income on the notes is treated as interest and taxed at ordinary income rates.

If the rate is set by the company rather than an index, it’s harder to determine the value of an investment, said Richard Saperstein, managing director at New York-based Treasury Partners, which is a unit of HighTower Advisors and advises corporations and individual investors.

Consumer Confusion

“Clearly they are playing off of consumers’ interest in eking out a little bit better return on their money than they can get from bank accounts or money-market funds,” said Barbara Roper, director of investor protection for the Consumer Federation of America.

Even though the risks are disclosed in the notes’ prospectuses, investors may still confuse the products with money markets or guaranteed accounts because of the features they offer, Reynolds, the investment adviser, said. “It looks like a duck, quacks like a duck and swims like a duck.”

To contact the reporters on this story: Margaret Collins in New York mcollins45@bloomberg.net; Elizabeth Ody in New York eody@bloomberg.net

To contact the editor responsible for this story: Christian Baumgaertel at cbaumgaertel@bloomberg.net

No comments:

Post a Comment