Ed Balls has warned that an emergency multibillion-pound package to inject lending into the British economy still fails to address the lack of economic confidence and demand. The shadow chancellor said the Bank of England's thinking still seemed to be driven by Montagu Norman, the governor who led it through the depression of the 1930s.

He said the measures announced on Thursday night at the Mansion House in London by the chancellor, George Osborne, and the bank's governor, Mervyn King, should have been implemented two years ago and would not work if businesses were not investing.

Osborne warned that the "debt storm" on the continent had left the UK and the rest of Europe facing their most serious economic crisis outside wartime. In a joint proposal between the Bank of England and the Treasury, banks will receive cut-price funds, provided they pass on the benefits to their business customers.

This new "funding for lending" scheme could provide an £80bn boost to loans to the private sector within weeks and alleviate growing fears of a second slump since the start of the financial crisis in 2007.

In a second scheme, within the next few days the bank will begin pumping a minimum of £5bn a month into City institutions to improve their liquidity.

Balls told Sky News: "Simply giving the banks billions of pounds doesn't translate into loans to business. If business is not investing and creating jobs and if our economy is not growing, that's the fundamental problem, and I've said consistently for two years that you can't do this simply by throwing money at the banks.

"You've got to accept that the fiscal plans of the chancellor haven't worked, they've backfired, they've taken us back into recession."

Speaking on BBC Radio 4's Today programme, Balls compared the government's fiscal policy to the 1930s depression era: "It failed then and it's failing now".

He said the announcements were a clear sign that the bank was worried. He did not dismiss the injection of cash for lending in principle, but argued that fiscal, as opposed to monetary policy was critical to recovery, pointing out that, apart from Italy, the UK was the only country in the G20 in recession.

The government has described the plans as an attempt to stretch its "plan A" to the limit. There has been concern from some banks that the plan does not change the dynamic as they will be expected to take the risk on the loans.

The treasury minister Mark Hoban told Today that the government's fiscal tightening had had no impact on growth. He said taxpayers' money would not be at risk as a result of the £80bn bank credit scheme.

Conservative MP Andrew Tyrie, chairman of the Commons treasury select committee, welcomed the plans: "The measures look as if they will encourage lending to businesses by ensuring liquidity is more easily available to banks."

Balls said: "The Bank of England's new funding for lending scheme is a significant admission that the government's existing policies have failed. Businesses will be desperately hoping it is more successful than George Osborne's Project Merlin and credit-easing schemes which have actually seen net lending to businesses fall."

He said Osborne's speech was dangerously complacent. "He is sticking with policies that have choked off the recovery, pushed up unemployment and are leading to £150bn of extra borrowing."

Balls also attacked Osborne over his remarks about a possible Greek exit from the eurozone.

"I was at the Mansion House last night and there was a frisson around the room when our chancellor started openly talking about whether Greece should leave the eurozone. I do not think that is a very wise or sensible thing to do," he told BBC Breakfast.

"I think Greece has got to sort out its issues – and that is a matter for Greece. What I am really worried about in the eurozone is that countries like Spain or Italy – which are huge, to which we as a country are very exposed – they have not sorted out their problems.

"Unless we get a global growth plan going, including in the eurozone, you can't turn this round. I am afraid that our government seems to be urging the wrong actions in Europe as it takes the wrong actions here in Britain too."

The shadow chancellor pointed out that Osborne had "snuck out another U-turn" in his speech, in particular to the objectives of the new financial policy committee at the bank.

"Labour and business organisations like the CBI have been calling for the new financial policy committee to have supporting economic growth as one of its key objectives. The chancellor voted against our amendment on this but in the face of an imminent defeat in the House of Lords he has now backed down."

India govt nominates finance minister for president - Channel NewsAsia

India govt nominates finance minister for president

Posted: 15 June 2012 2113 hrs

NEW DELHI - Indian Finance Minister Pranab Mukherjee, under fire for his recent handling of the rapidly slowing economy, is to step down after being named Friday as the ruling coalition's candidate for president.

The United Progressive Alliance (UPA) government, led by Mukherjee's Congress Party, announced that the 77-year-old minister would be its nominee for the largely ceremonial post of Indian head of state which falls vacant in July.

"There is broad support for his candidature," Congress supremo Sonia Gandhi said in a statement at a meeting of UPA leaders at the residence of Prime Minister Manmohan Singh.

The nomination means Mukherjee will have to resign as finance minister, with television reports suggesting he might step down on June 24.

There was no immediate announcement regarding his likely successor.

Although the president is India's titular head of state, the post is largely ceremonial, with real executive power residing with the prime minister and the cabinet.

Indian presidents are selected by an electoral college comprising MPs from both houses of parliament and state legislatures.

The election will be held July 19.

The choice of who will succeed the incumbent president, Pratibha Patil, has exposed fresh cracks in the increasingly fractured coalition, with its partners clashing over which candidate to put forward.

"The UPA appeals to all political parties and all members of parliament and members of state legislative assemblies to support the candidature of Pranab Mukherjee," Gandhi said in her statement.

Mukherjee's nomination comes at a time of growing criticism of his handling of the economy, which has slowed dramatically at a time of stubbornly high inflation and a depreciating rupee.

"I don't think that I am the depository of all knowledge and and expertise in our government. In our party there are a number of people who can handle the difficult economic situation," Mukherjee told reporters after his nomination.

"The prime minister himself (Manmohan Singh) is an eminent economist and under his stewardship we will overcome the temporary crisis."

In the January-March period, the economy grew just 5.3 percent, its slowest quarterly expansion in nine years.

Earlier this week, Standard & Poor's warned India could be the first of the BRIC emerging economies to lose its investment-grade rating unless the Asian giant revives its growth and spurs reforms.

In April, the firm changed India's credit outlook to negative from stable, maintaining India's rating at "BBB-" but warning it faced at least a one-in-three chance of losing its status if its public finances worsened.

"BBB-" is just one notch above "junk", which carries an increased risk of default and would see India having to pay higher interest rates on its public borrowing.

- AFP/ir

FOREX-Euro firm as c.banks gear to counter Greek fallout - Reuters

* Cenbanks' liquidity pledge triggers short-covering

* Soft US data keeps hopes of Fed easing alive

* Yen gains after BOJ stands pat

By Anirban Nag

LONDON, June 15 (Reuters) - The euro hovered below three-week highs against the U.S. dollar on Friday, as investors trimmed bearish bets on expectations that global central banks will step in to counter any adverse fallout from Sunday's election in Greece.

G20 officials told Reuters that central banks from major economies stand ready to take steps to stabilize financial markets by providing liquidity and preventing a credit squeeze if the Greek election result roils markets.

A coordinated action is likely to support risk appetite and provide relief to the euro although any bounce could prove temporary given Spain's elevated borrowing costs and the risk of contagion to Italy, the euro zone's third largest economy.

The dollar was also under pressure on expectations the U.S. Federal Reserve may resort to further monetary easing after labour market data disappointed and consumer prices fell in May.

The dollar index fell to a three-week low of 81.703 against a basket of currencies. The euro was steady on the day at $1.2630, not far from Monday's three-week high of $1.2672, struck after a 100 billion euro aid package for Spanish banks was agreed at the weekend.

Much of how the euro will trade in the near term will be dependent on the outcome of the Greek election on Sunday. Traders cited offers to sell above $1.2660 up to $1.2670 while option expiries were cited at $1.2600.

"Investors will be reluctant to hold any meaningful positions either way going into the weekend," said Ankita Dudani, G-10 currency strategist at RBS.

"The euro has come back from highs around $1.2650 and the only reason it will hold above $1.2500 is because of the extreme bearish positions and hopes of coordinated central bank action."

Hopes for more policy steps by major central banks have heightened after the UK government and the Bank of England unveiled a 100 billion pound ($155 billion) funding scheme for banks to boost credit on Thursday.

Traders agree that the euro has scope to post short term gains if Greece's pro-bailout parties manage to win a majority in Sunday's election.

"Such an outcome would initially support the euro, but markets will quickly realize that Greece is still mired in a deep recession and may well need to renegotiate the terms of its bailout, in our view," Morgan Stanley said in a note.

"Under this scenario we would look to fade any euro/dollar rallies."

In a scenario where the far-left anti-bailout parties win, the euro could drop towards near two-year lows of $1.2288 struck earlier this month.

The uncertainty was reflected in the options market, where both one-week and one-month implied volatilities traded at elevated levels of 16.50 percent and 12.65 respectively, up from around 9.8 percent and 11.55 percent at the end of last week.

BEARISH POSITIONS

In the past few weeks, speculators have added to very large bearish bets against the euro as many positioned for an eventual exit by Greece from the single currency and a possible spread of contagion to the bigger economies of Spain and Italy.

Spanish and Italian bond yields eased on Friday, but still remained near levels considered unsustainable to borrow from capital markets.

The steadily deteriorating situation in the euro zone has galvanised policymakers to consider taking action ahead of a G20 summit next week.

European Central Bank President Mario Draghi said on Friday the bank was ready to support euro zone banks, should it be required. Bank of Japan Governor Masaaki Shirakawa chimed in saying central banks can offer liquidity to calm markets in case the weekend Greek elections heighten tension.

All these comments supported risk appetite and weighed on safe-haven currencies like the dollar and the yen.

Against the yen, the dollar fell 0.6 percent to one-week low of 78.90 yen after the Bank of Japan announced no policy change, though that is in line with market expectations. A further dollar drop towards 78 yen is likely to raise caution over Japan's intervention.

Forex Trend Wave an Easy Application For Beginner Fx Traders Now Available - PRLog (free press release)

ForexTrend Wave is available online. The system is perfect beginner trader and advance user. This system is made for Meta Trader 4 and can be operated on 5 minute timeframe.

“If You Can Read Traffic Lights : Green, Yellow & Red To Cross The Street?" Then...You Can Trade With Forex Trend Wave, said Jess Palmer ( Forex Trend Wave Creator) Forex Trend Wave is so easy to use because all that have to do is follow the simple color coded sequence to enter a trade.

ForexTrend Wave Is It Worth to Buy Or Scam?

ForexTrendWave price is not too expensive. With only $87, traders can directly download the system and learn a lot of things to prepare them for smooth trading and high profit. No need to worry about the quality of the system because Palmer gives 60 days risk free and 100% money back guarantee, so traders have nothing to lose. The system teaches various methods to make trading so much more convenient and easier. With the system, all traders don’t have to get frustrated using various tools like Trend Lines, Harmonic Butterfly Pattern and Fibonacci tools. Traders don’t have to get frustrated with anything related to Triangles, Head and Shoulders and many others. ForexTrendWave will gives a lot of things like trading with near term trend, method to secure the profit, when the make buy and sell action, when to put stop loss, learn Support & Resistance and more. Creator of Forex Trend Wave also gives advanced version with audio alert.

It is a common thing to find pros and cons on Forex trading system and the cons will call the system as a scam. Well, overall, traders who have tried the system feel satisfy with the system. Determining which system is a scam and which one is the real effective system is quite hard. Traders need a guide to help them understand the quality of a system through a review like forex trend wave review. On http://signalforex.net , traders can get a complete guide including the answer whether a system is a scam or not.

If you more interesting about forex trend wave review visit http://www.signalforex.net/

Forex: GBP/USD rally approaches 1.57 - FXStreet.com

Easy money won’t sate hunger for real assets - Financial Times

Forex Trades for the Greek Elections and Wednesday's Fed Meeting - Marketwatch

By Benzinga.com

Over the coming days, two major events will dominate global markets: on Sunday, Greeks will vote in a national election. Then, next week, the Federal Reserve will hold its June meeting. Traders looking to take a position on these events may turn to the forex market to do so.

EUR/USD Traders can take a position on the outcome of the Greek election via the EUR/USD pair. Those who believe that there will be a negative outcome in Greece (a Radical Left victory) would want to short the EUR/USD, especially after the currency pair has seen recent gains. As the chart below shows, the pair is running into significant neckline support (the straight red line across the top) and is supported by the upward-sloping tend line from the lows hit at the end of May.

This technical formation is interesting in that it usually results in a breakout of prices, often to the upside. However, as this pattern is aligning with the fundamental story of the Greek elections, a wise trader would expect that the results will determine the next move. A negative outcome may send the pair lower, near $1.25 and then to $1.2450, where there are significant technical supports. Upside resistance is in the $1.2780-1.2820 range, so there is significant room for a move on either side.

Gold Some market watchers have said that a negative outcome from the Greek elections will prompt the Fed to take action next week. Traders who follow this view would be wise to buy gold as a hedge against aggressive monetary policy, and a great way to take a position would be with the XAU/EUR cross. Buying gold against the euro will allow traders to hedge dollar exposure ahead of the Fed meeting and also allow traders to grasp onto potential losses in the euro.

Looking at the above chart, support is not too strong until 1259 and then again at 1245, so those are the levels to watch on the downside. On the upside, resistance is at 1300 and then again just below 1315. For those who believe in the optimistic scenario, shorting this pair will allow traders to benefit twice: first from the expected fall in gold (diminished hopes of liquidity) and second from euro appreciation. On the other hand, those that feel a bad outcome is destined should buy this pair, as the long gold exposure is beneficial in situations of added liquidity and being short the euro will allow investors to have a bearish stance on the common currency.

Long the Spread of French 10-Year Bonds Over German 10-Year Any contagion effects of a negative outcome in the Greek elections will be felt in peripheral bonds as traders see European leaders not living up to their words (remember, it was only last summer that Merkel continuously reiterated that no nation is to leave the euro). A loss of confidence in these leaders will result in a dumping of peripheral debt, but the contagion could also move to France, the weakest of the core nations. If French finances start being called into check, French bond yields will move higher and capital flight may weaken the banks. France's two biggest banks, Societe Generale and BNP Paribas, had more assets than the GDP of France at the end of 2011. Thus, if they were to get into trouble, France would have to bail them out--thus putting serious pressure on the nation's finances.

This pressure would result in even higher bond yields and capital flight out of the banks and into German banks or even German bunds. Thus, German bond yields would fall and French yields would rise, driving the spread between them higher. As difficult as it may be to buy bunds at ultra-low yields, it may be the safest play still. By buying bunds, traders are investing in a negative real return (and potentially even negative nominal return), however they are getting an implied call option on a new German deutschmark. Consider that if the euro dissolves, each nation would revert to its own domestic currency. German bunds would then be re-denominated and paid out in this new currency, which would likely appreciate significantly against the euro (some say between 25-50%). Thus, by buying bunds and shorting French bonds, traders get exposure to the potentially negative sentiment surrounding the elections, the flight to quality and out of risky assets, and a call option on a new, stronger German currency.

(c) 2012 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Forex Traders Positioned for the Worst on Greek Elections - Caution - DailyFx

Upcoming Greek elections could force substantial volatility in the Euro and other major currency pairs, and a broad range of market indicators show that conditions show fears for the worst. DailyFX Currency Analyst Christopher Vecchio lays out the stakes and fundamental reasons for why Greek elections could materially change outlook for the Euro. Trader positioning likewise shows fear for the worst—how exactly?

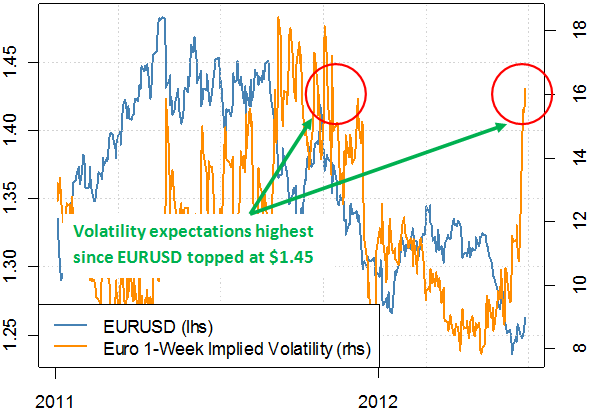

Forex options markets show that 1-week volatility expectations are at their highest since the Euro/US Dollar topped near the $1.45 mark in October, 2011. According to Bloomberg’s options data, traders are pricing in as much as a 200-pip daily range for the Euro every day through next week. The last time the Euro set a 200-point Average True Range (ATR) over 5 days occurred as it set a short-term top at $1.38 (on 11/14/2011) and subsequently fell a substantial 370 pips from its peak in that same week.

Traders should remain extremely cautious and limit positions and especially leverage ahead of the weekend. The inability to close/open positions as election results are announced creates significant risk of outsized losses. When markets open, we likewise expect markets will be extremely volatile and difficult to trade.

Euro 1-Week Implied Volatility Levels At Highest Levels since Critical EURUSD $1.45 Top

Data source: Bloomberg

Chart source: DailyFX.com, R-Project.org

Why do traders fear the worst? Quite simply, a far-left party victory could effectively push the government of Greece into default as party leaders have made it clear they intend to issue a moratorium on debt repayments and renege on bailout agreements.

No regional government has defaulted on its debt in the Euro’s 13-year history, and most expect that a Greek default would force it out of the Euro Zone. The size of the Hellenic Republic’s economy suggests that it should have relatively little impact on the broader region. Yet the most significant risk is that a Greek default forces substantial strains in at-risk in the EMU’s third and fourth-largest economies in Spain and Italy.

We can gauge overall fear of Greek default by the yields investors require for long-dated bonds; high yields show strong expected risk of default. An extremely negative correlation between Greek Government 10-Year Bond Yields and the Euro/US Dollar emphasizes the importance of the weekend’s elections. If Greek 10-Year bonds surge as traders prepare for default, correlations suggest the Euro/US Dollar could fall even further.

Data source: Bloomberg

Chart source: DailyFX.com, R-Project.org

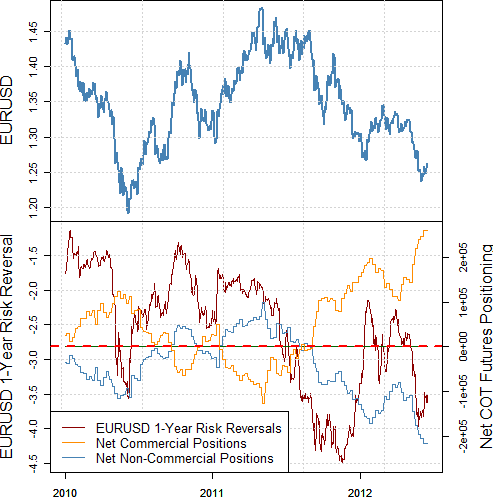

Given such clear risks to the Euro’s very existence, traders are quite clearly positioned for further declines. As of last week, large speculative futures traders were the most net-short Euro/US Dollar in history, while commercial hedgers were likewise at their most defensively net-long on record by a very large margin. Finally, FX Options traders are paying extremely largest premiums for aggressively bearish 1-Year EURUSD Options—underlining fears of substantial Euro weakness and ‘tail risk’.

Euro/US Dollar Futures and Options Traders Positioned for Aggressive Declines

Data Source: Commodity Futures Trading Commission, Bloomberg

Chart Source: DailyFX.com, R-Project.org

The writing on the wall tell us that the Euro could fall substantially on sharply negative disappointments, and trader positioning likewise shows that many are betting on or hedging aggressively against EURUSD weakness. Yet there is absolutely no guarantee that Greek elections will produce such negative outcomes. Volatility expectations themselves predict that price moves could be substantial in either direction.

In fact, such one-sided bearish sentiment and leveraged bets warn that a positive surprise could force a significant Euro recovery. Traders should remain extremely cautious ahead of the weekend, limit leverage, and trade defensively following Sunday’s market open.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive this author’s reports via e-mail, send subject line “Distribution List” to drodriguez@dailyfx.com

Contact this author via Twitter at http://www.Twitter.com/DRodriguezFX/

No comments:

Post a Comment